The COLA Explained

When I was in high school, Billy Joel sang, “Rock and Roll, the Cola Wars, I can’t take it anymore.” Spend 5 minutes trying to understand the FERS COLA and you’ll be saying the same thing. Even by government standards, this thing is unnecessarily complicated.

Uncle Sam doesn’t make it easy to understand. But I do. (Hopefully). Read on.

What Is It?

Here’s another reason to feel fortunate as a federal retiree: Our annuity (pension) is inflation-adjusted. What’s that mean? That means that as the things we buy get more expensive each year, the amount we receive as our FERS annuity is also increased. It’s like a raise for retirees.

Realize that in the private sector, not only are there not many pensions left, most of the ones that are out there are not adjusted for inflation. You get $1,500 a month at 62? Well, then that’s what you’re still getting at 92. As FERS retirees, we get a better deal.

Remember, when we are working, our salaries increase via raises (and promotions obviously), but in retirement, our annuities are increased via Cost of Living Adjustments (COLAs). Raises and COLAs can be the same in a year theoretically, but they very rarely are.

We’ll learn more about this in a bit, but if there is an increase in inflation, retirees may get a COLA. The important part to understand for now is this ONLY applies to the annuity part of your retirement. We do NOT get COLA’s on the FERS Supplement. That is a very common misconception out there. I have even seen financial planners write articles on the subject explaining exactly how the COLA is applied to the Supplement. And they were exactly wrong. There is NO COLA on the Supplement. Period.

Also, if you are still a FERS employee and you are working in say, New York, and you transfer to Miami, your COLA doesn’t change. You are not getting a COLA. You are getting a Locality Pay. And Locality Pay changes according to…well, your locality. I often hear COLA used for Locality Pay and vice versa. That’s incorrect and will just lead to confusion in the long run. Those terms are not interchangeable.

How Is It Calculated?

There’s some good news and bad news here. The good news is that it is not up to Congress to agree on a COLA, like they have to do on our raises. That takes it out of the hands of the politicians. The bad news is that the COLA is a response to inflation. And, because of the inflation metrics used by the government, it doesn’t really result in a raise in terms of real dollars. You may be happy that you get a 5% COLA, but if everything costs 7% more, you are still losing in the long run.

Anyway….

There is a metric in the government called the Consumer Price Index For Urban Wage Earners and Clerical Workers. This is generally shortened to CPI-W. (There are two CPI’s; this one is the W one). Theoretically, this metric measures the increase in costs of things that the average urban worker is exposed to. Think of it like this: a measurement of inflation.

This boring economic term is important to us because the FERS COLA formula is tied to the CPI-W. This is why I say Congress isn’t involved in determining our COLA—the formula set in law does that. Here’s how.

Step One. After the third quarter of the calendar year ends (Sept 30th), the CPI-W is measured for that quarter. It is then compared to the CPI-W of the year before. Then the increase is determined. For example, let’s say this September, the CPI-W was 103.5 and last September it was 100. That represents an increase (or inflation) of 3.5% for the year. (My numbers are made up numbers so you can understand it. The real CPI-W is in the mid to upper 200’s right now).

Step Two. We should only need Step One, right? The increase in the CPI-W could easily be our FERS COLA, but no. There is a second step. Find the increase on the FERS COLA chart and see how that translates into our new COLA moving forward. Again, it’s unnecessarily complicated.

If the CPI-W increase is less than 2%, then our COLA is the same as the CPI-W.

If the CPI-W increase is 2.0% to 3.0%, we get a flat 2% COLA.

If the CPI-W increase is over 3%, we get the CPI-W minus 1% as our COLA.

Example Time:

CPI-W is 1.3%. Then the FERS COLA is 1.3%

CPI-W is 2.4%. Then the FERS COLA is 2%

CPI-W is 6.1%. Then the FERS COLA is 5.1%

Doesn’t this seem complicated? Wouldn’t it be easier to just say, “The COLA is the same as the CPI-W?” Yes, of course it would be. And that is what is done for Social Security COLA. And what is also done for CSRS COLA.

So why is FERS COLA less? Remember Barfield Financial’s First Law of Governmental Motion: For every action the government takes, there is an equal and opposite reaction to our benefits. In other words, all change favors the government.

So the FERS COLA is probably going to be less than the CSRS many years. Thus the origin of the saying “FERS retirees get Diet COLAs”. If FERS had a Dad, this would be the joke he tells.

When Do I Get the FERS COLA?

This gets a little more confusing. It depends on what type of FERS you are. FERS SCE and Regular FERS get the COLA’s at vastly different times. So find the section applicable to you below and read that section. No need to read the rules that aren’t applicable to you. And if you’re Regular FERS, you probably don’t WANT to read the SCE portion—you’ll find out how badly you’re getting screwed.

FERS SCE

As a quick reminder, SCE stands for Special Category Employee, and includes your federal law enforcement, fire fighters, and air traffic controllers.

FERS SCE are eligible for a COLA immediately upon retirement. No minimum age to meet to start getting COLAs. Let’s say you came on at 21 and are retiring at 46, you can start getting COLAs at age 46. Just so you know, that’s 16 years sooner than Regular FERS are eligible to collect COLAs, so don’t go rubbing it in or anything. Just be thankful for your benefit.

That doesn’t mean you will get your COLA right away though. You may have to wait up to a year to get a COLA. In fact, that’s how long you will have to wait to get the full COLA. Why?

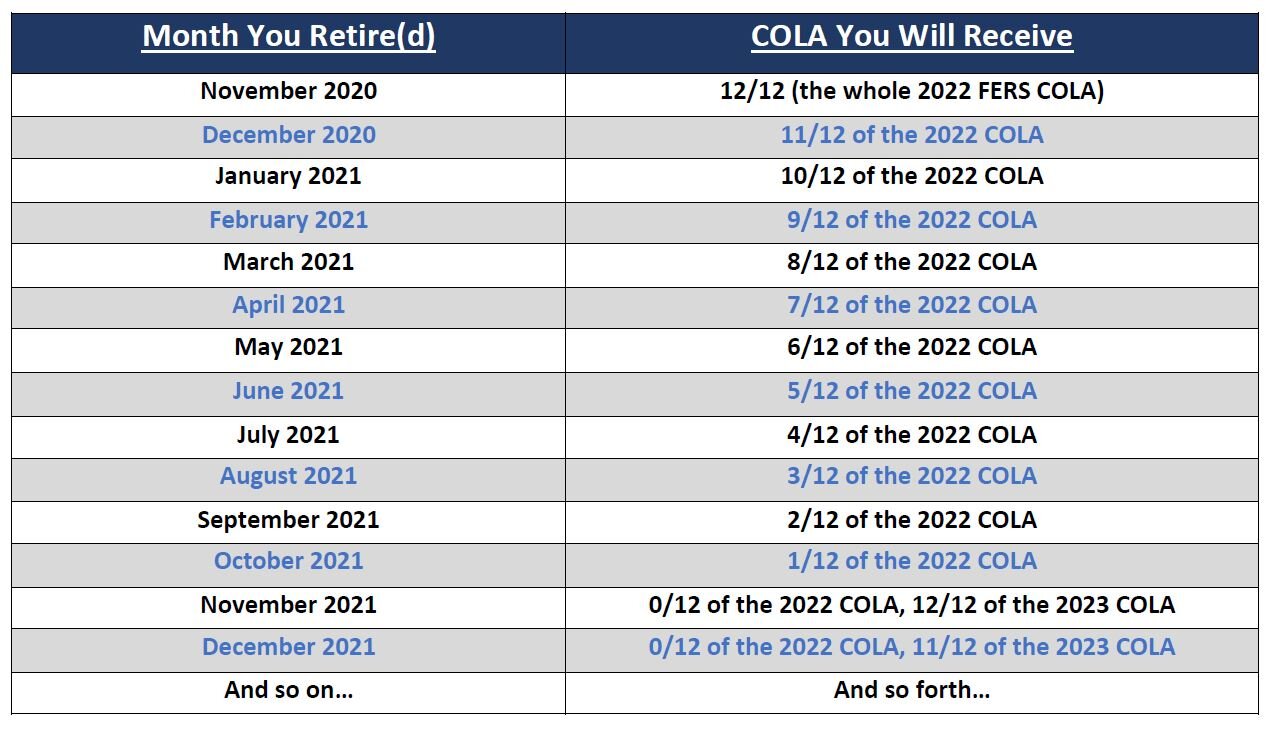

COLA’s become effective December 1st of each year, payable the next month in January. OPM regulations say that you have to have your annuity starting before November of each year in order to be eligible for the next year’s COLA. Meaning you have to retire no later than October 31st to get any COLA at all. (stick with me here, I’ve got a chart coming up that will make this easier to understand).

What that means is that for all those people that retire 12/31, they are not eligible for a COLA until the FOLLOWING December, because their annuity did not start prior to November of the year they retired.

But what if I don’t retire at the end of the year? I retire sooner. Like in August? Well, then you will have been eligible for an annuity several months before November, right? So you get a percentage of the COLA. You don’t get the whole thing cause you weren’t retired for the whole year. But you will get a portion of it.

In this case, if you retire in August, then your annuity becomes effective September 1st. You will then get 3/12’s of the FERS COLA (Sept, Oct, Nov). Because you were retired for 3 months of the “COLA YEAR” (my term—there is no such term in OPM language, but I think it helps to make it clearer.) You were retired for September, October, and November, the last month in the COLA year. Remember the COLA becomes effective on December 1st each year there is a COLA. So then November is the last month in the COLA Year.

And that’s where the chart below helps explain this:

Let’s look at a couple of examples:

Karen is planning on retiring in August of 2021. She’s had enough. She wants to beat the end of the year rush. And frankly, she doesn’t think it’s worth it to work an additional 4 extra months (~80 pay days) just to get an additional 8 extra annual leave days in her lump sum payout. (And I don’t blame her!) By retiring in August 2021, her annuity will start September 1st, 2021. Now, let’s also assume a COLA of 5% for 2022 (we won’t know until mid-October, but 5% is in the ballpark).

By retiring in August, Karen will be eligible for 3/12th’s of the 5% COLA. 3/12th’s = 1/4. 1/4 of the 5% = 1.25%. So Karen’s FERS annuity will be increased by 1.25%, first payable in January of 2022. In January of 2023, and every year after that, she’ll get the full COLA, assuming there is a COLA for that year.

Leanne is planning on going all the way to the end of 2021. Retiring 12/31/21. Leanne will not receive any COLA until January of 2023. And at that time, she will receive 11/12 of whatever the 2023 COLA will be. (We wouldn’t know that until mid-October of 2022).

I get that this is a bit confusing. I didn’t write the law. If I did, you’d all be able to understand it. Just remember this, if you retire at the end of the year, you’ll have to sit on the sidelines for awhile before you start to get any COLA. The earlier you retire in the year, the sooner you get COLA, although you’ll still only get a partial COLA for that first year.

Remember: For SCE’s, this is true regardless of your age.

REGULAR FERS

The chart detailed above is applicable for you. And the examples work for you. But you have one other hurdle to overcome that throws a wrench into the system. You have to be 62 years of age before you can start collecting a FERS COLA. I realize it’s not fair. You should get the same as SCE’s. I’ll retire at 50. I’ll get 12 years of COLAs before a Regular FERS employee will be eligible for one.

Let’s take two FERS employees, one Regular, one SCE. They both retire at age 57. Assume a COLA of 2% a year. By the time they are both 62, the SCE’s annuity has increased 11%, while the Regular’s annuity is still the same as it was 5 years ago. Not cool, Congress.

The good news is this. If you have been retired for at least 1 year prior to turning age 62, when you do turn age 62, you’re eligible for the entire COLA. It is not prorated like in the example above.

This can be a little tricky since OPM says that if you aren’t 62 by December 1st, you’re ineligible for a COLA for the following year. If you are 62 by December 1st, but you don’t have a full year in retirement yet, you’ll receive a prorated amount, based on when you retired. Let’s look at just a couple of examples:

Brandon retired in May of 2021. He’s 59 years old. He’s ineligible for a COLA until December 1st, 2024, when he will be 62. He will receive the full COLA then, starting in his January 2025 check.

Maxine retired in October of 2021. She is 62 years old. She would be entitled to 1/12th of 2022 COLA. She satisfied the first hurdle of being 62 by December 1st. But she doesn’t have a full year in retirement. So we have to go to the chart and see that she gets 1/12th for 2022, starting with January 2022’s payment. She’ll get all of it for 2023.

SUMMARY

I realize this is a lot, but here’s the thing—you don’t need to know a bunch of different combinations. All you need to know is ONE. What is applicable to YOU. That’s only one thing. So determine if you are Regular or SCE, then determine when you’re going to retire on the chart. For SCE’s that’s all you have to do. For Regular, you’ll have the additional calculation of determining when you’ll be 62.

There are other COLA issues for survivors or for disability retirements. I think we’ve gone over enough for now. If you want to research those, try Chapter 2 of the FERS Handbook.

Some review questions:

What is COLA? Cost of Living Adjustment. The increase in our annuity because of inflation.

What will the 2022 COLA be? We won’t know until mid-October of 2021, but it looks like it might be around 5%.

I will retire on 12/31/21, will I get the 2022 COLA? No, you’ll get none of it. You have to retire in October 2021 or before to get any of the 2022 COLA.

At what age are retirees eligible? SCE = any age. Regular = 62.

Do we get COLA’s on our Supplement? No

Is the FERS COLA the same as the Social Security COLA? It will generally be less, but can be the same if the CPI-W is small.

What is the average COLA? For the last 10 years, the average has been 1.47%. For the last 20 years, the average has been 1.72%.

Do we get a COLA every year? Nope. 2010, 2011, and 2016 were all goose eggs. 2017 was very close at only .30%.

What’s the highest COLA in recent history? Since 1999, the highest has been 4.8% (2009). We have not had another one in the 3’s or 4’s since.

Is the COLA applied to our annuity pre-tax? After-tax? Before/After survivor benefit? It is applied to the FERS annuity AFTER reductions have been made for the survivor benefit, but BEFORE any deductions for taxes, healthcare premiums, life insurance premiums, etc.